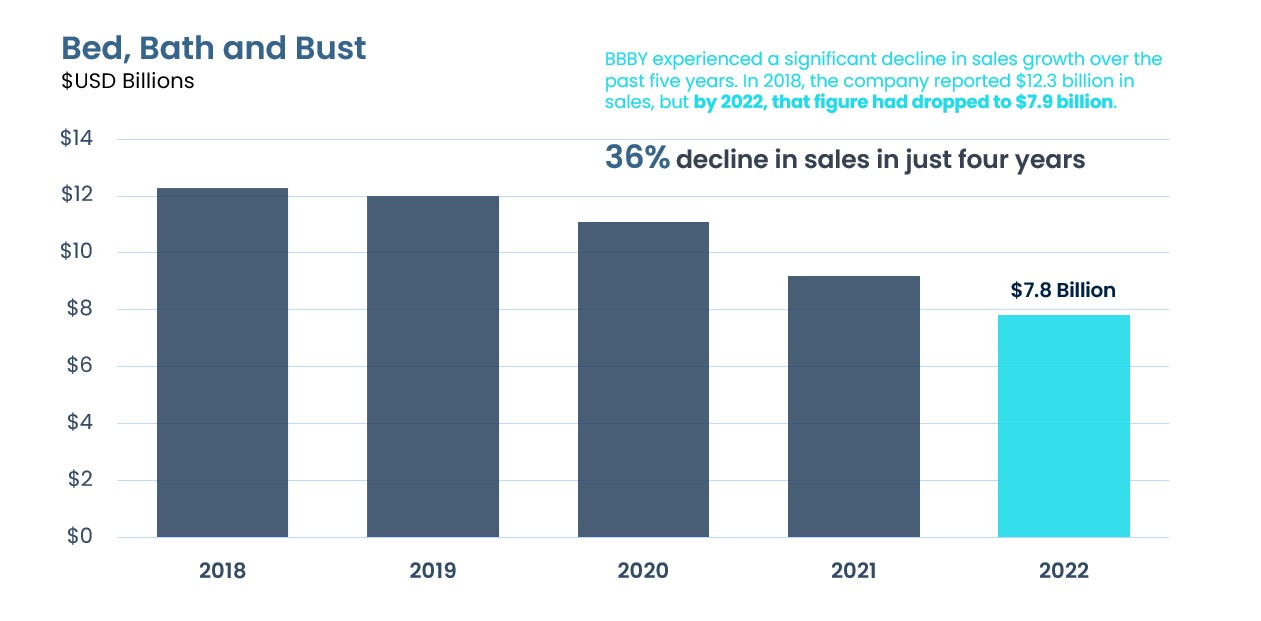

This weekend Bed Bath & Beyond (BBBY) filed for Chapter 11 bankruptcy. As recently as 2019, this frequent ABM target was booming with 1,500+ stores while generating $12+ Billion in revenue.

So what happened?

1. Failure to adapt to e-commerce: Bed Bath & Beyond was slow to adapt to the rise of online retail, which began to eat into its business. The rise of e-commerce contributed to the decline in sales over the years. While the company made some efforts to catch up when it came to online shopping, it was not enough to keep up with competitors like Amazon, Target & Wal-mart. The company’s closure is another example of the decline of “category killers,” such as Toys “R” Us and Circuit City, as shoppers turn to online options like Amazon, and highlights the challenges facing traditional brick-and-mortar retailers in an increasingly digital marketplace. This was acknowledged in a 2023 interview with founder Warren Eisenberg, “If we made an error by not moving fast enough into the internet, it wasn’t because we wouldn’t spend the money. It was that we goofed. We didn’t realize fast enough how the internet would have such a major effect on retail.”

2. Financial mismanagement: Bed Bath & Beyond’s financial troubles were not solely due to external factors such as the pandemic or competition from e-commerce. The company spent over $1 billion on buying back its own stock from 2020 to 2022, eating into its cash reserves. Additionally, the company had fallen behind on payments to suppliers and was running low on cash by the end of 2022, despite efforts to close stores and reduce staff. The failed attempts to secure financing and the bankruptcy filing suggest that the company was unable to effectively manage its finances. In its bankruptcy filing, Bed Bath & Beyond said it had $5.2 billion in debt and assets of just $4.4 billion. It secured $240 million in financing just to stay afloat just long enough to close its stores and wind down its operations.

3. Overreliance on private label goods: Bed Bath & Beyond’s decision to replace well-known brands with private-label goods was a sound strategy in theory, as private-label goods typically carry higher margins and help retailers differentiate their offerings from competitors. However, the company rolled out too many private brands too quickly, before it had the infrastructure to support them. Additionally, the switch was made during a time when supply chains had been upended by the pandemic, making it difficult for retailers to keep goods flowing to their stores in a timely manner. As a result, customers were left uncertain about the quality of the private-label goods, and sales declined.

What’s next? Starting this week Bed Bath & Beyond will be closing all of its 360 Bed Bath & Beyond and 120 buybuy BABY retail stores and websites as the company seeks to sell its business. BBBY is hoping to find a buyer that will allow it to halt the store closings, but if no buyer comes forward, Bed Bath & Beyond will likely be liquidated entirely. It is possible that the company could emerge from bankruptcy as an online-only retailer, but as a “shadow of its former self.” A sad ending for the 14,000 loyal workers of this once Fortune 500 retail powerhouse.

Major Tech Investments Were Underway: Too Little, Too Late

Before the bankruptcy, PipelineIQ research reports showed that Bed Bath & Beyond wasn’t going down without a fight. They were focusing its efforts on becoming an omni-channel leader as part of a massive $1.5 billion transformation. Specific areas of investment we explored in recent client reports included:

Omni-Channel Focus and Security Concerns

Bed Bath & Beyond wanted to lead with a digital-first, omni-always approach to build authority in core markets and make it easy to feel at home. The starting point for re-establishing Bed, Bath & Beyond as the omni-channel home destination was $1.5 billion worth of business and technology transformation and taking in partners like Oracle, Deloitte and Google Cloud. The company focused on omni-channel and digital to serve customers in stores, online, or through the app, and changes were delivered through re-designed business and IT processes and tech enablers to deliver new capabilities to the business. In 2021, the modernization of the supply chain was one of the core operational transformation initiatives to create greater efficiencies and reduce ‘out of stock’ occurrences for customers.

Modernization of IT Infrastructure

BBBY made drastic changes to its infrastructure in support of modernization and transformation efforts. Many of the technologies in place were evaluated or replaced to create a more agile environment. Google Cloud was the primary cloud provider, but the company did leverage solutions from AWS and Microsoft. The big data environment was made up of HDFS, YARN, Hive, NiFi, Spark, PySpark, Scala, Kafka, and Erwin for data modeling. BBBY divested several companies (Cost Plus World Market and Christmas Tree Shops) to focus on the core brands. It transformed how it operated and how it could improve the customer experience through re-designed business and IT capabilities at the center of the transformation. Other key initiatives from 2021 and 2022 included the launch of an integrated, cross-banner website, where customers could shop Bed Bath & Beyond, buybuy BABY, and Harmon in one transaction, and a new digital marketplace to expand the assortment of key products with key partners and be integrated into the BBBY digital platform. The vision was that customer accounts would be connected across all brands for online and mobile app activity, including shopping, registries, and promotions.

BBBY’s Renewed Focus and Evolving Technology Landscape

Bed Bath and Beyond modernized and evaluated every aspect of the business and technology to support it. New tech leadership and a focus on modernizing legacy systems was poised to allow IT to evolve faster and better integrate modern technologies. BBBY IT operations had been a custom development shop, running a lot of 1990s technology (including Lotus Notes), but the transformation program was a full modernization of business applications, infrastructure, and also new ways of working for the IT organization. The strategy was to build applications for differentiation and buy applications for existing retail solutions and foundational capabilities. Applications were modernized throughout retail, corporate and store systems.

Conclusion

The story of Bed Bath & Beyond serves as a cautionary tale for other retailers. The rise of e-commerce and the convenience of online shopping has forever changed the retail landscape. Retailers must adapt to changing customer behavior and preferences, invest in modern technology, and provide a seamless, omnichannel shopping experience. Additionally, retailers should focus on optimizing their supply chain and inventory management to avoid stock shortages and lost sales. By heeding these lessons learned, retailers can avoid the same fate as Bed Bath & Beyond and position themselves for long-term success in the competitive retail industry.