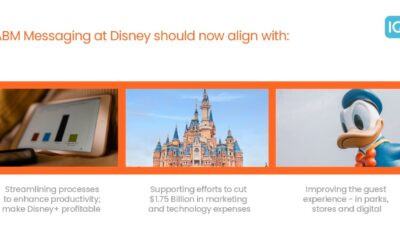

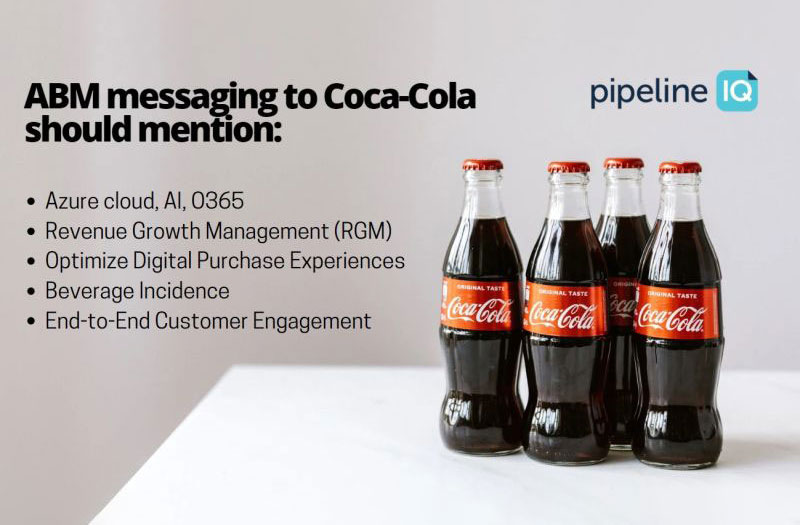

Learn how this global brand is investing in modernization and new digital platforms to connect online and offline experiences. For #B2B enterprise sales and #ABM marketers targeting Coca-Cola in 2022, here are 3 things to keep in mind from today’s Q1 earnings:

1. Year 3 of the Microsoft Partnership

Coca-Cola is heavily invested in Microsoft since 2020, including #Azure cloud, AI, O365, D365 and a commitment to modernize digital experiences for 700K employees and customers. Each day, over 1.9B servings of Coca-Cola products are consumed by customers in 200 countries. Microsoft is playing a major role in improving productivity, engagement, information management, modernization and collaboration across the globe.

2. Digital Purchasing Experience / Engagement

With WPP as their new marketing partner, they enter 2022 focused on new digital platforms to connect online and offline experiences. They are investing heavily in AI & Machine Learning to understand consumer behavior and buying patterns to drive growth. In their Q1 2022 earnings, Coca Cola talks about relying on data insights to identify “passion points” and “improve connections” with customers. B2B Tech Vendors selling to Coca-Cola should demonstrate how your solutions can help improve end-to-end customer engagement, by creating more relevant, personalized experiences for customers and retailers. A unique key metric relevant to Coca-Cola you will get props for mentioning is “improving beverage incidence”, the percentage of total food transactions that include the sale of a beverage.

3. Excellence in Revenue Growth Management (RGM)

RGM at Coca-Cola means finding new growth opportunities by segmenting markets based on occasion, brand, price, package and channel. They’ve had success so far in 2022 offering more ways for consumers to get their products – such as affordable single-serve packages. Coca-Cola is on the upswing as their revenue is more reliant on consumption “outside of the home” (i.e. stadiums, events, restaurants), unlike PepsiCo who saw huge surges in their snack division revenue as people stayed home during the pandemic. Pepsi stock increase in 2021 was double that of Coca-Cola. But entering 2022, Coca-Cola and their bottling partners are achieving growth through creative RGM and a return to post-pandemic activities; despite inflation, global conflicts, and ongoing supply chain disruptions.